6 Easy Facts About Clark Wealth Partners Explained

Little Known Questions About Clark Wealth Partners.

Table of ContentsThe Main Principles Of Clark Wealth Partners Fascination About Clark Wealth PartnersThe Main Principles Of Clark Wealth Partners Getting My Clark Wealth Partners To WorkExcitement About Clark Wealth PartnersTop Guidelines Of Clark Wealth PartnersClark Wealth Partners - TruthsThe Single Strategy To Use For Clark Wealth Partners

Common reasons to take into consideration an economic expert are: If your financial situation has actually ended up being much more complex, or you lack confidence in your money-managing abilities. Saving or browsing major life events like marriage, separation, children, inheritance, or task modification that may dramatically influence your monetary situation. Navigating the change from conserving for retired life to preserving wide range throughout retired life and exactly how to produce a solid retirement earnings plan.New technology has actually led to more detailed automated financial devices, like robo-advisors. It depends on you to investigate and determine the best fit - https://writeablog.net/clrkwlthprtnr/financial-advisors-illinois-trusted-guidance-for-your-financial-future. Eventually, an excellent financial expert ought to be as conscious of your financial investments as they are with their own, preventing extreme fees, saving cash on taxes, and being as clear as possible about your gains and losses

4 Easy Facts About Clark Wealth Partners Shown

Earning a payment on product referrals doesn't always suggest your fee-based advisor works against your benefits. But they may be extra likely to advise products and solutions on which they make a payment, which may or may not remain in your benefit. A fiduciary is lawfully bound to place their client's interests initially.

They might comply with a loosely checked "viability" criterion if they're not signed up fiduciaries. This standard enables them to make referrals for financial investments and services as long as they match their customer's objectives, risk resistance, and monetary scenario. This can equate to referrals that will additionally gain them money. On the various other hand, fiduciary advisors are legally obliged to act in their customer's finest passion rather than their very own.

What Does Clark Wealth Partners Mean?

ExperienceTessa reported on all things investing deep-diving right into complicated economic topics, clarifying lesser-known financial investment opportunities, and discovering ways visitors can work the system to their benefit. As an individual financing specialist in her 20s, Tessa is acutely familiar with the effects time and unpredictability carry your investment choices.

It was a targeted ad, and it functioned. Find out more Check out much less.

The Facts About Clark Wealth Partners Revealed

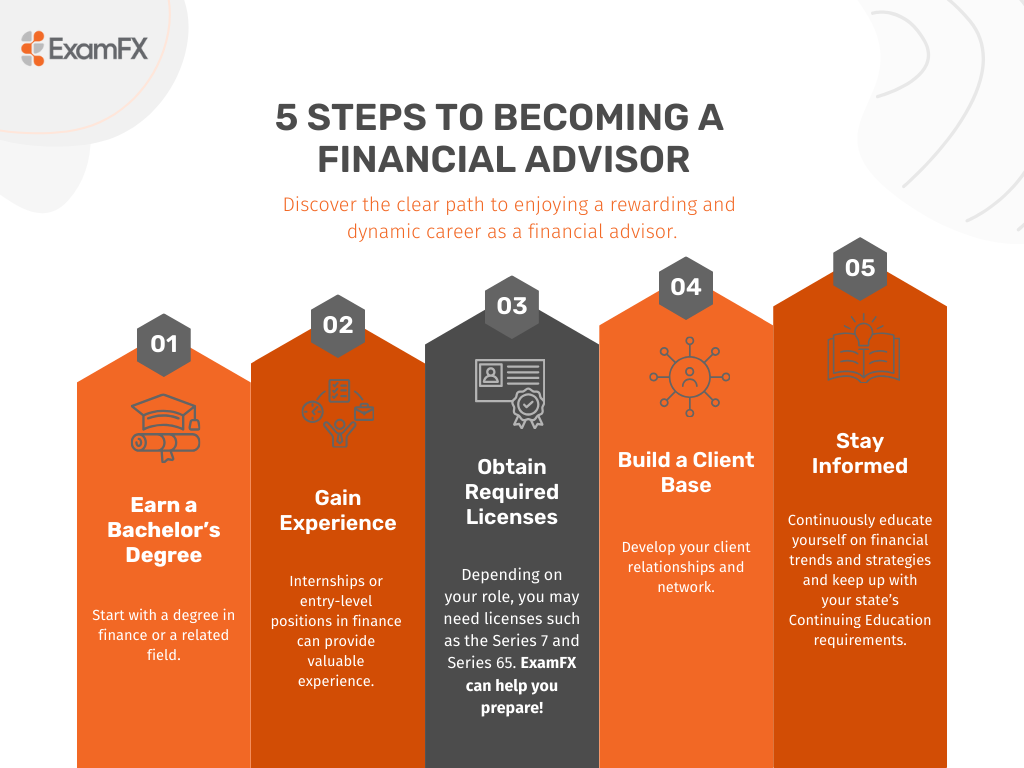

There's no single course to coming to be one, with some people starting in financial or insurance coverage, while others begin in audit. A four-year degree gives a solid foundation for professions in financial investments, budgeting, and customer services.

.jpg)

The 9-Minute Rule for Clark Wealth Partners

Usual instances consist of the FINRA Collection 7 and Collection 65 examinations for safeties, or a state-issued insurance policy permit for selling life or health insurance policy. While credentials might not be lawfully required for all planning duties, companies and clients typically view them as a criteria of professionalism and reliability. We check out optional qualifications in the following section.

The majority of economic planners have 1-3 years of experience and experience with financial items, compliance standards, and direct customer interaction. A strong educational history is important, however experience demonstrates the capability to use theory in real-world setups. Some programs combine both, enabling you to complete coursework while earning supervised hours with internships and practicums.

See This Report on Clark Wealth Partners

Many enter the field after operating in financial, bookkeeping, or insurance policy, and the transition calls for perseverance, networking, and often innovative qualifications. Early years can bring long hours, stress to develop a customer base, and the requirement to continuously verify your know-how. Still, the occupation uses strong long-term capacity. Financial coordinators enjoy the opportunity to function carefully with customers, overview essential life decisions, and usually achieve adaptability in schedules or self-employment.

They spent much less time on the client-facing side of the sector. Nearly all financial managers hold a bachelor's degree, and lots of have an MBA or similar graduate degree.

All about Clark Wealth Partners

Optional qualifications, such as the CFP, commonly need additional coursework and screening, which can extend the timeline by a couple of years. According to the Bureau of Labor Data, individual economic consultants gain an average annual annual salary of $102,140, with top income earners gaining over $239,000.

In other districts, there are regulations that require them to satisfy particular requirements to utilize the financial consultant or monetary planner titles. For monetary planners, there are 3 common designations: Certified, Personal and Registered Financial Organizer.

The Greatest Guide To Clark Wealth Partners

Those on income may have an incentive to advertise the product or services their employers use. Where to locate an economic consultant will certainly rely on the kind of suggestions you need. These organizations have team who might help you recognize and acquire particular kinds of investments. For example, term deposits, assured financial investment certifications (GICs) and mutual funds.